Financial and managerial accounting 7th edition by wild – Financial and Managerial Accounting, 7th Edition by Wild embarks on an illuminating journey, delving into the intricacies of accounting principles, financial analysis, and management accounting. This comprehensive guide equips readers with the knowledge and skills necessary to navigate the complexities of financial decision-making.

The book meticulously unfolds the fundamental concepts of financial accounting, exploring the principles of accrual and cash basis accounting. It then guides readers through the accounting cycle, explaining each step and its significance in maintaining accurate financial records. The exploration continues with an in-depth examination of financial statements, highlighting their purpose and interrelationships.

1. Accounting Concepts and Principles

Financial accounting is the process of recording, classifying, and summarizing financial transactions to provide information that is useful for decision-making.

The fundamental concepts of financial accounting include:

- The entity concept: A business is considered a separate entity from its owners.

- The going concern concept: A business is assumed to be a going concern, meaning that it will continue to operate in the foreseeable future.

- The monetary unit concept: Financial statements are prepared in terms of a single currency.

- The periodicity concept: Financial statements are prepared for specific periods of time, such as monthly, quarterly, or annually.

The principles of accrual accounting and cash basis accounting are two different methods of recording financial transactions.

- Accrual accounting: Transactions are recorded when they occur, regardless of when cash is received or paid.

- Cash basis accounting: Transactions are recorded only when cash is received or paid.

Accrual accounting is the more widely used method of accounting because it provides a more accurate picture of a company’s financial performance.

2. The Accounting Cycle

The accounting cycle is the process of recording, classifying, and summarizing financial transactions to produce financial statements.

The steps involved in the accounting cycle are:

- Recording transactions in a journal

- Posting journal entries to the ledger

- Preparing a trial balance

- Adjusting the trial balance

- Preparing financial statements

- Closing the books

The accounting cycle is a continuous process that repeats itself at the end of each accounting period.

3. Financial Statements

Financial statements are the end product of the accounting cycle. They provide information about a company’s financial performance and position.

The three main financial statements are:

- Balance sheet: A snapshot of a company’s financial position at a specific point in time.

- Income statement: A summary of a company’s revenues and expenses over a period of time.

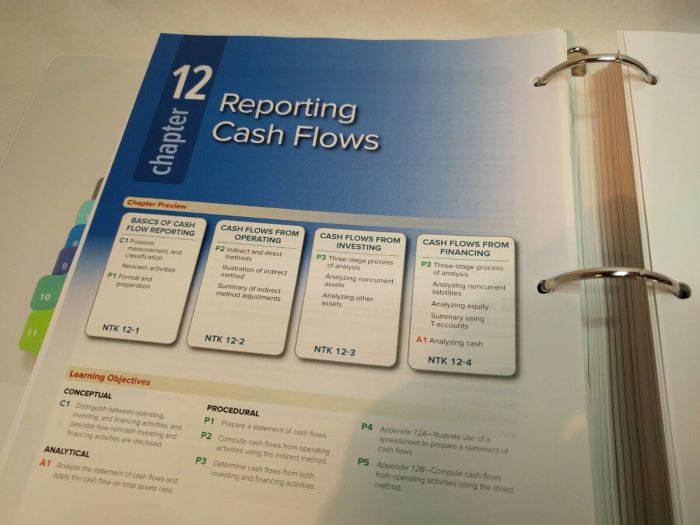

- Statement of cash flows: A summary of a company’s cash inflows and outflows over a period of time.

Financial statements are used by investors, creditors, and other stakeholders to make informed decisions about a company.

FAQ: Financial And Managerial Accounting 7th Edition By Wild

What is the primary focus of financial accounting?

Financial accounting focuses on providing information to external users, such as investors and creditors, to help them make informed decisions about a company’s financial health.

How does management accounting differ from financial accounting?

Management accounting provides information primarily for internal users, such as managers and employees, to help them plan, control, and make decisions within the organization.

What is the importance of budgeting in financial management?

Budgeting helps organizations allocate resources effectively, control expenses, and forecast future financial performance.